In the world of international trade and commerce, trust is a critical factor. However, when two parties from different countries engage in business transactions, establishing trust can be challenging. This is where Letters of Credit (LC) come into play. A Letter of Credit is a financial instrument issued by a bank that guarantees payment to the seller (beneficiary) once certain conditions are met. It serves as a safety net for both buyers and sellers, ensuring that transactions proceed smoothly.

In this blog, we’ll explore what a Letter of Credit is, its importance, and the different types of LCs used in global trade.

What is a Letter of Credit?

A Letter of Credit is a written commitment by a bank on behalf of the buyer (applicant) to pay the seller (beneficiary) a specified amount of money within a predetermined timeframe, provided the seller meets the terms and conditions outlined in the LC. Essentially, it acts as a guarantee that the seller will receive payment as long as they fulfill their obligations, such as delivering goods or services as agreed.

For businesses involved in cross-border trade, LCs are particularly valuable because they mitigate risks associated with unfamiliar trading partners, currency fluctuations, and legal differences between countries.

Why Are Letters of Credit Important?

- Risk Mitigation: For sellers, an LC eliminates the risk of non-payment since the bank assumes responsibility for payment upon meeting the agreed terms.

- Trust Building: In international trade, where parties may not know each other well, an LC fosters confidence between buyers and sellers.

- Flexibility: LCs can be tailored to suit specific transaction requirements, making them adaptable to various industries and scenarios.

- Cash Flow Management: Buyers benefit from structured payment timelines, while sellers gain assurance about receiving funds.

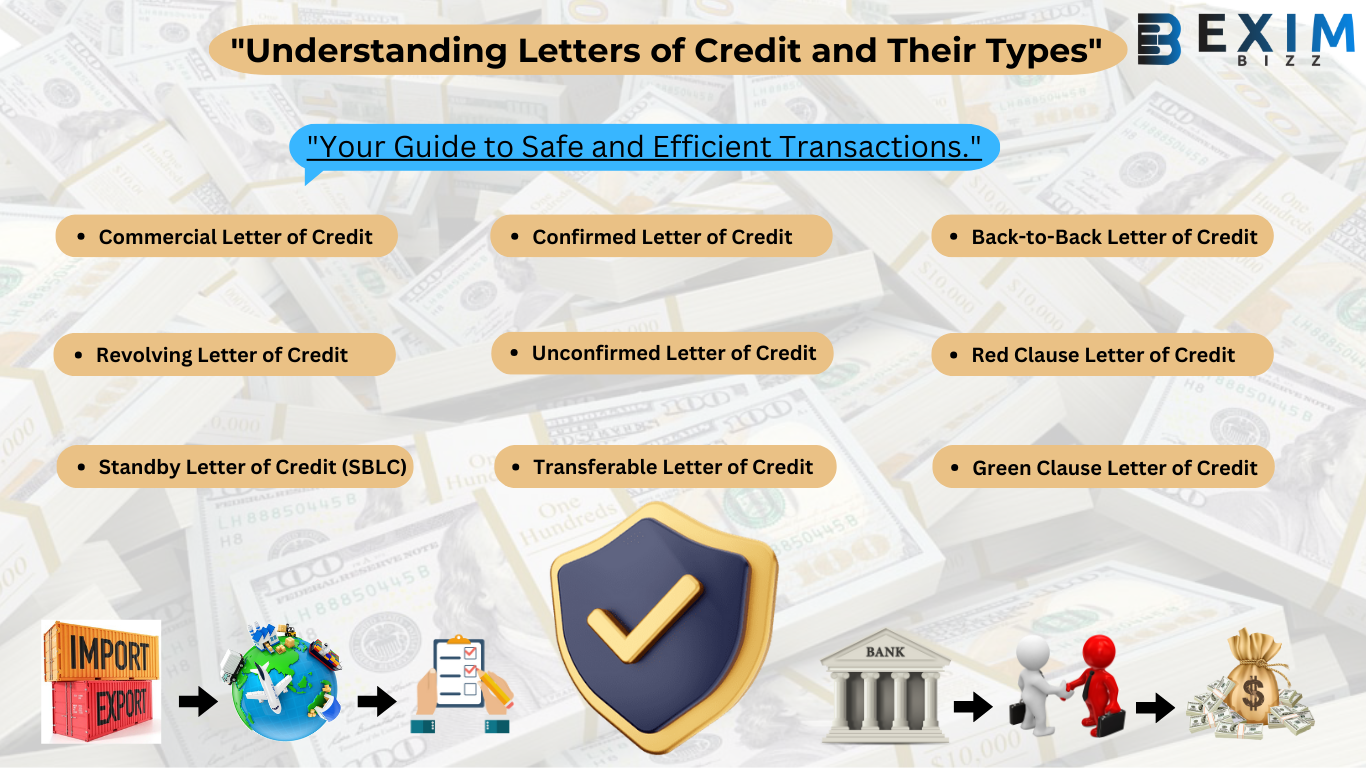

Types of Letters of Credit

There are several types of Letters of Credit designed to cater to different needs and circumstances. Let’s take dig deeper for the most common Lc’s:

- Commercial Letter of Credit

- Also known as a Documentary Letter of Credit, this is the standard type of LC used in trade finance. The issuing bank pays the beneficiary directly once the required documents (e.g., invoices, bills of lading) are presented.

- Revolving Letter of Credit

- Ideal for ongoing business relationships, a Revolving LC allows multiple draws against the same credit line over a specified period. It’s commonly used when buyers and sellers have recurring transactions.

- Standby Letter of Credit (SBLC)

- Unlike traditional LCs, which are primarily used for facilitating payments, SBLCs act as a secondary payment mechanism. They ensure payment only if the buyer fails to fulfill their contractual obligations. Essentially, it’s a backup plan for the seller.

- Confirmed Letter of Credit

- In a Confirmed LC, another bank (usually in the seller’s country) adds its confirmation to the LC, guaranteeing payment even if the issuing bank defaults. This provides additional security for the seller, especially in politically unstable regions.

- Unconfirmed Letter of Credit

- Here, no second bank confirms the LC, meaning the seller relies solely on the issuing bank’s ability to honor the payment. While less secure than a confirmed LC, it’s still widely used in trusted banking systems.

- Transferable Letter of Credit

- This type allows the original beneficiary (often a middleman) to transfer part or all of the credit to a third party, typically the actual supplier. It’s useful in cases involving intermediaries.

- Back-to-Back Letter of Credit

- A Back-to-Back LC involves two separate LCs: one issued by the buyer’s bank to the intermediary and another issued by the intermediary’s bank to the ultimate supplier. It’s commonly used when the intermediary doesn’t have sufficient funds to purchase goods upfront.

- Red Clause Letter of Credit

- A Red Clause LC allows the seller to access partial funding before shipping the goods. The advance is usually intended to cover production costs, making it beneficial for cash-strapped suppliers.

- Green Clause Letter of Credit

- Similar to a Red Clause LC, but with added provisions for warehousing. The seller receives an advance after proving that the goods have been stored in a designated warehouse.

How Does a Letter of Credit Work?

The process of using a Letter of Credit generally involves the following steps:

- Agreement Between Buyer and Seller: Both parties agree to use an LC as part of their sales contract.

- Issuance of LC: The buyer requests their bank to issue an LC in favor of the seller.

- Transmission to Seller’s Bank: The issuing bank sends the LC to the seller’s bank (advising/confirming bank).

- Shipment and Documentation: The seller ships the goods and prepares the necessary documents as per the LC terms.

- Presentation of Documents: The seller submits the documents to their bank.

- Payment Processing: After verifying the documents, the advising bank forwards them to the issuing bank, which then pays the seller.

- Goods Delivery: The buyer receives the goods upon presenting the required documents.

Advantages and Disadvantages of Letters of Credit

Advantage

- Provides security for both buyers and sellers.

- Facilitates international trade by bridging trust gaps.

- Offers flexibility through various types of LCs.

- Ensures timely payment and reduces disputes.

Disadvantages

- Can be expensive due to bank fees.

- Requires meticulous documentation, which can delay payments.

- Relies heavily on adherence to strict terms; minor errors can lead to rejection.

Conclusion

Letters of Credit are indispensable tools in modern trade, offering peace of mind to both buyers and sellers. By understanding the different types of LCs and how they work, businesses can choose the best option to suit their needs and minimize risks. Whether you’re a seasoned trader or new to the world of commerce, leveraging LCs effectively can help you build stronger partnerships and grow your business globally.

If you’re considering incorporating Letters of Credit into your operations, consult with your bank or financial advisor to determine the most suitable approach for your transactions. With the right strategy, LCs can become a cornerstone of your success in international trade.