Setting up an export business is a dream every person wishes to have, trading of goods and services or shipping products from one country to another requires a set of mandatory documents, legal restrains, product knowledge, international market analysis, digital presence, product quality standards and appropriate importers data to establish your foot in the international market. Product laboratory certifications (if required) in order to pass through the Government regulations eligibility criteria of both the importers and exporters COUNTRIES.

The basic documents that are needed to comply are:-

- Company Incorporation

- Goods & services tax (G.S.T)

- Ministry of Micro, Small and Medium Enterprises (Udhyam Aadhar) or M.S.M.E

- Import Export Code (I.E.C)

- Registration Cum Membership Certificate (R.C.M.C)

- AD Code Registration (BANK)

- Port Registration

In addition there are several more documents that would be needed and would be understood as we go down the lane enhancing our knowledge to meet the criteria for exporting of goods and services from India.

Let’s get some brief information about the above list of documents

- COMPANY INCORPORATION :-

Company incorporation is an identity or a representation of any company who wishes to establish their business either in the domestic market or international market. Company incorporation can be a state level or a central government registered company, there are 5 basic types of company incorporated in India.

- PROPRIETORSHIP

- PARTNERSHIP COMPANY

- ONE PERSON COMPANY (OPC) PVT. LTD.

- LIMITED LIABILITY PARTNERSHIP (LLP)

- PRIVATE LIMITED COMPANY (PVT LTD.)

Proprietorship or a proprietor company and partnership company are registered under shop act licenses’ and is a state governed company which can be started by any individual with a low budget, where as OPC, LLP & PVT. LTD. Are registered under MCA (Ministry of Corporate Affairs) central government of India and requires a set of documents compliances to comply and get the company registered under central government.

- GOODS AND SERVICE TAX (G.ST)

G.S.T is a tax that is to be paid by consumers on all goods and services when they buy including transport, fooding, shelter, clothes, accessories etc. The tax in not directly paid by the consumers but levied by the manufacturers, resellers services, industries. It was first introduced in India on 1st july 2017 by the Prime Minister of India Shri Narendra Modi. Every entity needs to acquire a gst number who either exceeds his annual turnover more than 20 lakhs or can voluntarily take gst number to avail several tax benefits in domestic as well as international. Gst number is mandatory for exporters to keep a track record of goods that are being exported from India, taxes are exempted for exporters in India and can claim once documents submitted and listed on the ICEGATE portal and claim incentives on DGFT portal.

- MINISTRY OF MICRO, SMALL AND MEDIUM ENTERPRISES (M.S.M.E)

It has been an initiative taken by the government of India to support the Micro, Small and Medium Enterprises Development and was first introduced in the 2006 for promotion, development and enhance competitiveness to help and grow small and medium enterprises. The government of India has sub divided its responsibilities to its state governing bodies to assist, encourage and promote businesses and entrepreneurs in upbringing talent and technology into focus and supporting them to expand with effective measures. MSME’S also support micro, small and medium enterprises financially by providing them short term loans known as Mudra loans.

- IMPORT EXPORT CODE (I.E.C CODE)

I.E.C code has been mandatory for every individual, entity or companies either for importing or exporting of goods and services. It can be obtained on the DGFT portal and is renewal every year between april- june, it is basically an identification number or kind of passport for your product to track record of your business and appears to be same as of on pan card when applied individually.

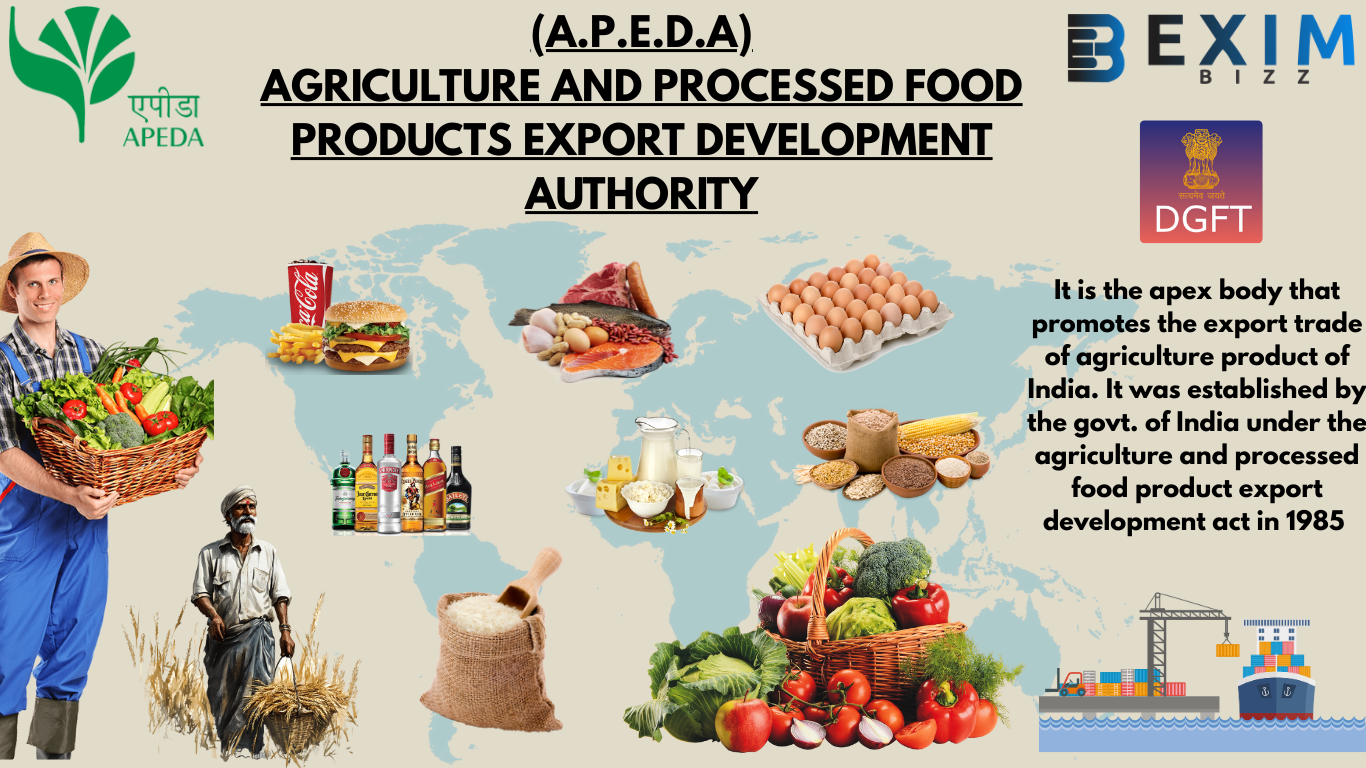

- REGISTRATION CUM MEMBERSHIP CERTIFICATE (RCMC)

RCMC is a mandatory certificate sub divided under 36 Authority/organization/Agency for exporters dealing in several products and is managed by the export promotion councils under the government of India, It basically acts as a visa for your products after all the criteria have met the councils issue approval for products or services that are eligible to export overseas.

Apart from these certificates there are several more certificates required, here is the list of certificates that are OPTIONAL or as per product category needed:-

- TRADEMARK ™ (OPTIONAL)

Developing a business and Creating a brand image takes a lot of hard work and patience but without registration the business can not be patent under your name. Trademark ™ is also known as brand registration

- FFSAI (THE FOOD SAFETY AND STANDARDS AUTHORITY OF INDIA )

It is a statutory body established under food , health and welfare authority of India headquartered at New Delhi, ffsai certificate can be state certified and central government certified. For exports central ffsai is required.

- HALAL CERTIFICATE

Mostly required on importers demand usually in gulf countries such as UAE, QATAR, OMAN, SAUDI ARABIA

- KOSHER CERTIFICATE

It is also similar to halal certificate but required in Iran and Iraq on importers demand.

- F.D.A CERTIFICATE (FOOD AND DRUG ADMINISTRATION)

It is a mandatory certificate required for the U.S.A. and mostly for the EUROPIAN countries as the overseas government needs the products to be quality standards as per their quality standard checklist

- UKAS (UNITED KINGDOM ACCREDITATION SERVICE)

UKAS is a national accreditation authority assigned by the UK government to check and provide services for the product quality, testing, inspection and calibration.

- PHYTO SANITARY CERTIFICATE

This certificate is mostly issued during the trade shipment of fresh perishable goods, certificate is issued after tests and verification of the goods that are pests and germ free.